After you stop working your 9 to 5, your money can keep working for you.

停下你的朝九晚五工作后,你的钱可以继续为你工作。

Conclusion: The Just Keep Buying Rules

Highlight(yellow) - Page 281 · Location 4366

Saving is for the Poor, Investing is for the Rich Find where you are in your financial journey before deciding where to focus your time and energy. If your expected savings are greater than your expected investment income, focus on savings; otherwise focus on investing. If they are similar, focus on both. (Ch. 1)

Highlight(yellow) - Page 281 · Location 4370

Save What You Can Your income and spending are rarely fixed, so your savings rate shouldn’t be fixed either. Save what you can to reduce your financial stress. (Ch. 2)

Highlight(yellow) - Page 281 · Location 4373

Focus on Income, Not Spending Cutting spending has its limits, but growing your income doesn’t. Find small ways to grow your income today that can turn into big ways to grow it tomorrow. (Ch. 3)

Highlight(yellow) - Page 281 · Location 4376

Use The 2x Rule to Eliminate Spending Guilt If you ever feel guilty about splurging on yourself, invest the same amount of money into income-producing assets or donate to a good cause. This is the easiest way to have worry-free spending. (Ch. 4)

Highlight(yellow) - Page 282 · Location 4379

Save at Least 50% of Your Future Raises and Bonuses A little lifestyle creep is okay, but keep it below 50% of your future raises if you want to stay on track. (Ch. 5)

Highlight(yellow) - Page 282 · Location 4382

Debt Isn’t Good or Bad, It Depends on How You Use It Debt can be harmful in some scenarios and helpful in others. Use debt only when it can be most beneficial for your finances. (Ch. 6)

Highlight(yellow) - Page 282 · Location 4385

Only Buy a Home When the Time Is Right Buying a home will probably be the biggest financial decision you ever make. As a result, you should only do it when it fits into both your finances and your current lifestyle. (Ch.

Highlight(yellow) - Page 282 · Location 4388

When Saving for a Big Purchase, Use Cash Though bonds and stocks may earn you more while you wait, when saving for a wedding, home, or other big purchase, cash is the way to go. (Ch. 8)

Highlight(yellow) - Page 282 · Location 4391

Retirement is About More Than Money Before you decide what to retire from, make sure you know what you want to retire to. (Ch. 9)

Highlight(yellow) - Page 283 · Location 4394

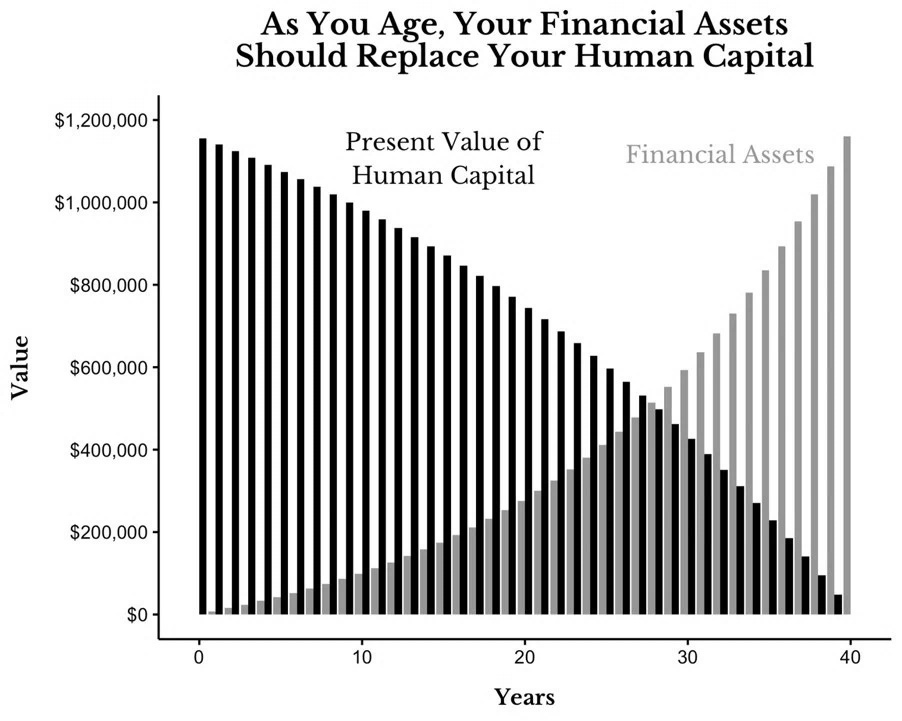

Invest to Replace Your Waning Human Capital with Financial Capital You won’t be able to work forever, so replace your human capital with financial capital before it’s too late. Investing is the best way to accomplish this. (Ch. 10)

Highlight(yellow) - Page 283 · Location 4397

Think Like an Owner and Buy Income-Producing Assets To really grow your income, think like an owner and use your money to buy income-producing assets. (Ch. 11)

Highlight(yellow) - Page 283 · Location 4400

Don’t Buy Individual Stocks Buying individual stocks and expecting to outperform is like flipping a coin. You might succeed, but even if you do, how do you know it wasn’t just luck? (Ch. 12)

Highlight(yellow) - Page 283 · Location 4402

Buy Quickly, Sell Slowly Since most markets are expected to rise over time, buying quickly and selling slowly is the optimal way to maximize your wealth. If you don’t feel comfortable with this, then what you are buying/ selling might be too risky for you. (Ch. 13, 18)

Highlight(yellow) - Page 283 · Location 4406

Invest As Often As You Can If you think you can time the market by saving up cash, think again. Even God couldn’t beat dollar-cost averaging. (Ch. 14)

Note - Page 283 · Location 4409

绝对不可能

Highlight(yellow) - Page 284 · Location 4409

Investing Isn’t About the Cards You Are Dealt, but How You Play Your Hand You will experience periods of good and bad luck throughout your investing career. However, the most important thing is how you behave over the long term. (Ch. 15)

Highlight(yellow) - Page 284 · Location 4412

Don’t Fear Volatility When It Inevitably Comes Markets won’t give you a free ride without some bumps along the way. Don’t forget that you have to experience some downside if you want to earn your upside. (Ch. 16)

Highlight(yellow) - Page 284 · Location 4415

Market Crashes Are (Usually) Buying Opportunities Future returns are usually the highest following major crashes. Don’t be afraid to take advantage of these crashes when they periodically occur. (Ch. 17)

Highlight(yellow) - Page 284 · Location 4418

Fund the Life You Need Before You Risk it for the Life You Want Though this book is called Just Keep Buying, sometimes it’s okay to sell. After all, what’s the point of building your wealth if you don’t do anything with it? (Ch. 18)

Highlight(yellow) - Page 284 · Location 4421

Don’t Max Out Your 401( k) Without Considerable Thought The annual benefit of a 401( k) can be less than you think. Before you lock up your money for multiple decades, consider what else you might need it for instead. (Ch. 19)

Highlight(yellow) - Page 285 · Location 4424

You’ll Never Feel Rich and That’s Okay No matter how successful you get with your money, there will always be someone with more. If you win the financial game, make sure you don’t lose yourself in the process. (Ch. 20)

Highlight(yellow) - Page 285 · Location 4428

Time is Your Most Important Asset You can always earn more money, but nothing can buy you more time. (Ch. 21)

Introduction

Highlight(yellow) - Page 9 · Location 118

To build wealth it didn’t matter when you bought U.S. stocks, just that you bought them and kept buying them. It didn’t matter if valuations were high or low. It didn’t matter if you were in a bull market or a bear market. All that mattered was that you kept buying.

Highlight(yellow) - Page 10 · Location 124

When I say income-producing assets, I mean those assets that you expect to generate income for you far into the future, even if that income isn’t paid directly to you. This includes stocks, bonds, real estate, and much more. However, the specifics of the strategy are not critically important.

Highlight(yellow) - Page 10 · Location 127

It’s not about when to buy, how much to buy, or what to buy—just to keep buying.

Highlight(yellow) - 1. Where Should You Start? > Page 13 · Location 171

saving is for the poor and investing is for the rich

Highlight(yellow) - 1. Where Should You Start? > Page 15 · Location 207

First, figure out how much you expect to comfortably save in the next year.

Highlight(yellow) - 1. Where Should You Start? > Page 15 · Location 210

Next, determine how much you expect your investments to grow in the next year (in dollar terms).

Highlight(yellow) - 1. Where Should You Start? > Page 15 · Location 213

Finally, compare the two numbers. Which is higher, your expected savings or your expected investment growth?

Highlight(yellow) - 1. Where Should You Start? > Page 15 · Location 215

If your expected savings are higher, then you need to focus more on saving money and adding to your investments. However, if your expected investment growth is higher, then spend more time thinking about how to invest what you already have. If the numbers are close to each other, then you should spend time on both.

I. Saving

Highlight(yellow) - 3. How To Save More > Page 36 · Location 526

This is why it is so much easier for higher income households to save money—they don’t spend on necessities at the same rate, relative to their income, as lower income households.

Note - 3. How To Save More > Page 36 · Location 528

储蓄率

Highlight(yellow) - 3. How To Save More > Page 37 · Location 546

“Why Do People Stay Poor?”

Highlight(yellow) - 3. How To Save More > Page 37 · Location 550

“[ We] find that, if the program pushes individuals above a threshold level of initial assets, then they escape poverty, but, if it does not, they slide back into poverty… Our findings imply that large one-off transfers that enable people to take on more productive occupations can help alleviate persistent poverty.” 18

Highlight(yellow) - 3. How To Save More > Page 38 · Location 554

many poor people stay poor not because of their talent/ motivation, but because they are in low-paying jobs that they must work to survive.

Highlight(yellow) - 3. How To Save More > Page 38 · Location 560

This is why the biggest lie in personal finance is that you can be rich if you just cut your spending.

Highlight(yellow) - 3. How To Save More > Page 39 · Location 577

If you want to save more, the main point is to tighten up where you can, then focus on increasing your income.

Highlight(yellow) - 3. How To Save More > Page 39 · Location 587

Sell Your Time/ Expertise Sell a Skill/ Service Teach People Sell a Product Climb the Corporate Ladder

Highlight(yellow) - 3. How To Save More > Page 40 · Location 603

Selling Your Time Summary Pros: Easy to do. Low startup cost. Cons: Time is limited. Doesn’t scale.

Highlight(yellow) - 3. How To Save More > Page 41 · Location 618

Selling a Skill/ Service Summary Pros: Higher pay. Able to build a brand. Cons: Need to invest time to develop marketable skill/ service. Doesn’t scale easily.

Highlight(yellow) - 3. How To Save More > Page 42 · Location 633

Teaching People Summary Pros: Easily scalable. Cons: Lots of competition. Attracting students can be an ongoing battle.

Highlight(yellow) - 3. How To Save More > Page 42 · Location 639

The best way to do this is to identify a problem and then build a product to solve it. The problem could be emotional, mental, physical, or financial in nature. Whatever you decide on, solving a problem through a product helps you create scalable value.

Highlight(yellow) - 3. How To Save More > Page 43 · Location 647

Selling a Product Summary Pros: Scalable. Cons: Lots of upfront investment and constant marketing.

Highlight(yellow) - 3. How To Save More > Page 44 · Location 671

Climbing the Corporate Ladder Summary Pros: Gain skills and experience. Less risk around income growth. Cons: You don’t control your time or what you do.

Highlight(yellow) - 3. How To Save More > Page 44 · Location 676

Regardless of how you try to increase your income in the future, all of the methods above should be viewed as temporary measures. I say temporary because, ultimately, your extra income should be used to acquire more income-producing assets. That’s how you really give your savings a boost.

II. Investing

Bookmark - 10. Why Should You Invest? > Page 114 · Location 1803

Highlight(yellow) - 10. Why Should You Invest? > Page 115 · Location 1827

why you should invest: To save for your future self. To preserve your money against inflation. To replace your human capital with financial capital.

Highlight(yellow) - 10. Why Should You Invest? > Page 118 · Location 1871

with an inflation rate of 5% annually, purchasing power is halved every 14 years.

Highlight(yellow) - 11. What Should You Invest In? > Page 127 · Location 2020

It is this highly volatile nature of stocks that makes them difficult to hold during turbulent times. Seeing a decade’s worth of growth disappear in a matter of days can be gut-wrenching even for the most seasoned investors.

Highlight(yellow) - 11. What Should You Invest In? > Page 127 · Location 2023

The best way to combat such emotional volatility is to focus on the long term. While this does not guarantee returns, the evidence of history suggests that, with enough time, stocks tend to make up for their periodic losses. Time is an equity investor’s friend.

Highlight(yellow) - 11. What Should You Invest In? > Page 128 · Location 2041

Stocks Summary Average compounded annual return: 8%–10%. Pros: High historic returns. Easy to own and trade. Low maintenance (someone else runs the business). Cons: High volatility. Valuations can change quickly based on sentiment rather than fundamentals.

Highlight(yellow) - 11. What Should You Invest In? > Page 130 · Location 2076

Why You Should/ Shouldn’t Invest in Bonds I recommend bonds because of these characteristics: Bonds tend to rise when stocks (and other risky assets) fall. Bonds have a more consistent income stream than other assets. Bonds can provide liquidity to rebalance your portfolio or cover liabilities.

Highlight(yellow) - 11. What Should You Invest In? > Page 133 · Location 2113

Bonds Summary Average compounded annual return: 2%–4% (can approach 0% in a low-rate environment). Pros: Lower volatility. Good for rebalancing. Safety of principal. Cons: Low returns, especially after inflation. Not great for income in a low-yield environment.

Highlight(yellow) - 11. What Should You Invest In? > Page 136 · Location 2156

Investment Property Summary Average compounded annual return: 12%–15% (dependent on local rental conditions). Pros: Higher returns than other more traditional asset classes, especially when using leverage. Cons: Managing the property and tenants can be a headache. Hard to diversify.

Highlight(yellow) - 11. What Should You Invest In? > Page 138 · Location 2199

REITs Summary Average compounded annual return: 10%–12%. Pros: Real estate exposure that you don’t have to manage. Less correlated with stocks during good times. Cons: Volatility greater than or equal to stocks. Less liquidity for non-traded REITs. Highly correlated with stocks and other risk assets during stock market crashes.

Highlight(yellow) - 11. What Should You Invest In? > Page 142 · Location 2278

Small Business Summary Average compounded annual return: 20%–25%, but expect lots of losers. Pros: Can have extremely outsized returns. The more involved you are, the more future opportunities you will see. Cons: Huge time commitment. Lots of failures can be discouraging.

Highlight(yellow) - 11. What Should You Invest In? > Page 147 · Location 2351

What About Gold, Crypto, Art, Etc? A handful of asset classes did not make the above list for the simple reason that they don’t produce income. Gold, cryptocurrency, commodities, art, and wine have no reliable income stream associated with their ownership, so I have not included them in my list of income-producing assets. Of course, this does not mean that you can’t make money with these assets. What it does mean is that their valuations are based solely on perception—what someone else is willing to pay for them. Without underlying cash flows, perception is everything.

Note - 11. What Should You Invest In? > Page 147 · Location 2357

没有现金流

Highlight(yellow) - 12. Why You Shouldn’t Buy Individual Stocks > Page 150 · Location 2456

Why You Shouldn’t Buy Individual Stocks

Highlight(yellow) - 12. Why You Shouldn’t Buy Individual Stocks > Page 151 · Location 2487

The mental turmoil. The fear of missing out. The elation, triumph, pain, and regret. It was all perfectly packaged into a single two-hour window. Battling emotions is just the tip of the stock picking iceberg. I know because I used to pick stocks years ago as well. In addition to the emotional difficulties, you also have to deal with periods of underperformance and the possibility that you don’t actually have any stock picking skill.

Highlight(yellow) - 12. Why You Shouldn’t Buy Individual Stocks > Page 157 · Location 2576

“The very best way to learn about the dangers of individual stock investing is to familiarize yourself with the basics of finance and the empirical literature. But if you can’t do that, then, sure, what you have to do is put 5% or 10% of your money into individual stocks. And make sure you rigorously calculate your return, your annualized return, and then ask yourself, ‘Could I have done better just by buying a total stock market index fund?’” 82

Highlight(yellow) - 13. How Soon Should You Invest? > Page 161 · Location 2649

Most stock markets go up most of the time. This is true despite the chaotic and sometimes destructive course of human history. As Warren Buffett so eloquently stated: “In the 20th century, the United States endured two world wars and other traumatic and expensive military conflicts; the Depression; a dozen or so recessions and financial panics; oil shocks; a flu epidemic; and the resignation of a disgraced president. Yet the Dow rose from 66 to 11,497.”

Highlight(yellow) - 13. How Soon Should You Invest? > Page 161 · Location 2658

Given this empirical evidence, it suggests that you should invest your money as soon as possible. Why is this? Because most markets going up most of the time means that every day you end up waiting to invest usually means higher prices you will have to pay in the future. So, instead of waiting for the best time to get invested, you should just take the plunge and invest what you can now.

Highlight(yellow) - 13. How Soon Should You Invest? > Page 161 · Location 2664

Imagine you have been gifted $ 1 million and you want to grow it as much as possible over the next 100 years. However, you can only undertake one of two possible investment strategies. You must either: Invest all your cash now, or Invest 1% of your cash each year for the next 100 years. Which would you prefer? If we assume that the assets you are investing in will increase in value over time (otherwise why would you be investing?), then it should be clear that buying now will be better than buying over the course of 100 years. Waiting a century to get invested means buying at ever higher prices while your uninvested cash also loses value to inflation.

Highlight(yellow) - 13. How Soon Should You Invest? > Page 162 · Location 2676

“The best time to start was yesterday. The next best time is today.”

Highlight(yellow) - 13. How Soon Should You Invest? > Page 163 · Location 2684

Why Better Prices in the Future are Likely (And Why You Shouldn’t Wait for Them)

Highlight(yellow) - 13. How Soon Should You Invest? > Page 176 · Location 2909

If you think that the market is overvalued and due for a major pullback, you may need to wait years, if ever, before you are vindicated. Consider this before you use valuation as an excuse to stay in cash.

Highlight(yellow) - 13. How Soon Should You Invest? > Page 176 · Location 2911

Final Summary When deciding between investing all your money now or over time, it is almost always better to invest it now. This is true across all asset classes, time periods, and nearly all valuation regimes. Generally, the longer you wait to deploy your capital, the worse off you will be.

Highlight(yellow) - 13. How Soon Should You Invest? > Page 177 · Location 2915

I say generally because the only time when you are better off by averaging-in over time is while the market is crashing. However, it is precisely when the market is crashing that you will be the least enthusiastic to invest.

Highlight(yellow) - 13. How Soon Should You Invest? > Page 177 · Location 2917

It is difficult to fight off these emotions, which is why many investors won’t be able to keep buying as the market falls anyways.

Highlight(yellow) - 13. How Soon Should You Invest? > Page 177 · Location 2919

If you are still worried about investing a large sum of money right now, the problem may be that you’re considering a portfolio that is too risky for your liking. What’s the solution to this? Invest your money now into a more conservative portfolio than you normally would.

Highlight(yellow) - 13. How Soon Should You Invest? > Page 177 · Location 2921

If your target allocation is a 80/ 20 stock/ bond portfolio, you might want to consider investing it all into a 60/ 40 stock/ bond portfolio and transitioning it over time.

Highlight(yellow) - 14. Why You Shouldn’t Wait to Buy the Dip > Page 178 · Location 2939

14. Why You Shouldn’t Wait to Buy the Dip Even God couldn’t beat dollar-cost averaging

Highlight(yellow) - 14. Why You Shouldn’t Wait to Buy the Dip > Page 179 · Location 2961

Why is this true? Because buying the dip only works when you know that a severe decline is coming and you can time it perfectly.

Highlight(yellow) - 14. Why You Shouldn’t Wait to Buy the Dip > Page 179 · Location 2962

The problem is that severe market declines don’t happen too often. In U.S. market history severe dips have only taken place in the 1930s, 1970s, and 2000s. That’s rare. This means that Buy the Dip only has a small chance of beating DCA.

Highlight(yellow) - 14. Why You Shouldn’t Wait to Buy the Dip > Page 189 · Location 3050

You should invest as soon and as often as you can.

Highlight(yellow) - 16. Why You Shouldn’t Fear Volatility > Page 204 · Location 3269

How much would the market have to decline in the next year for you to forgo investing in stocks altogether to invest in bonds instead?

Highlight(yellow) - 16. Why You Shouldn’t Fear Volatility > Page 208 · Location 3308

The answer is 15% and above.

Highlight(yellow) - 16. Why You Shouldn’t Fear Volatility > Page 212 · Location 3341

“If you’re not willing to react with equanimity to a market price decline of 50% two or three times a century, you’re not fit to be a common shareholder and you deserve the mediocre result you’re going to get.”

Highlight(yellow) - 17. How to Buy During a Crisis > Page 221 · Location 3457

As you can see, when U.S. equity markets have gotten cut in half, the future annualized returns usually exceed 25%. This implies that when the market is down by 50%, it’s time to back up the truck and invest as much as you can afford. Of course, you may not have a lot of investable cash to take advantage of these rare occurrences when the market is in turmoil, because of wider economic uncertainty. However, if you do have the cash to spare then the data suggests that it would be wise to take advantage of this buying opportunity.

Highlight(yellow) - 18. When Should You Sell? > Page 226 · Location 3523

When Should You Sell? On rebalancing, concentrated positions, and the purpose of investing

Highlight(yellow) - 18. When Should You Sell? > Page 226 · Location 3530

fear of missing out on the upside and the fear of losing money on the downside. This emotional vice can make you question every investment decision that you make.

Highlight(yellow) - 18. When Should You Sell? > Page 226 · Location 3532

To avoid this mental turmoil, you should come up with a set of conditions under which you would sell beforehand instead of relying on your emotional state when you are thinking of getting out of a position. This will allow you to sell your investments on your own terms, to a predefined plan. After coming up with a list of reasons myself, I can only find three cases under which you should consider selling an investment: To rebalance. To get out of a concentrated (or losing) position. To meet your financial needs. If you aren’t rebalancing your portfolio, getting out of a concentrated (or losing) position, or trying to meet a financial need, then I see no reason to sell an investment—ever.

Highlight(yellow) - 18. When Should You Sell? > Page 227 · Location 3546

it’s usually better to buy immediately rather than over time. The reasoning was simple: since most markets go up most of the time, waiting to buy usually means losing out on upside. When it comes to selling an asset, we can use the same set of reasoning, but come to the opposite conclusion. Since markets tend to go up over time, the optimal thing to do is to sell as late as possible. Therefore, selling over time (or as late as possible) is usually better than selling right away.

Highlight(yellow) - 18. When Should You Sell? > Page 227 · Location 3553

buy quickly, but sell slowly.

Highlight(yellow) - 18. When Should You Sell? > Page 228 · Location 3559

What’s Rebalancing Good for Anyways? “Perfectly balanced, as all things should be.”

Highlight(yellow) - 18. When Should You Sell? > Page 231 · Location 3593

Given that rebalancing doesn’t typically enhance returns, why do people still do it? To reduce risk.

Highlight(yellow) - 18. When Should You Sell? > Page 234 · Location 3629

result, I recommend an annual rebalance for two reasons: It takes less time. It coincides with our annual tax season.

Highlight(yellow) - 18. When Should You Sell? > Page 234 · Location 3642

Whatever you decide to do when it comes to rebalancing frequency, avoiding unnecessary taxation is a must. This is why I don’t recommend rebalancing frequently in your taxable accounts (i.e., brokerage account). Because every time you do, you have to pay Uncle Sam.

Highlight(yellow) - 18. When Should You Sell? > Page 235 · Location 3647

While selling an asset to rebalance isn’t the worst thing in the world, there is a way to rebalance your portfolio that involves no tax consequences at all—Just Keep Buying. That’s right. You can buy your way back into a rebalanced portfolio. I call this an accumulation rebalance because you are rebalancing by buying your most underweight asset over time.

Highlight(yellow) - 18. When Should You Sell? > Page 239 · Location 3707

The point is that underperformance is inevitable and not a good reason to sell.

Highlight(yellow) - 18. When Should You Sell? > Page 240 · Location 3719

Fund the life you need before you risk it for the life you want.

Highlight(yellow) - 20. Why You Will Never Feel Rich > Page 261 · Location 4053

Why You Will Never Feel Rich And why you probably already are

Highlight(yellow) - 21. The Most Important Asset > Page 272 · Location 4217

The Most Important Asset And why you’ll never get any more of it